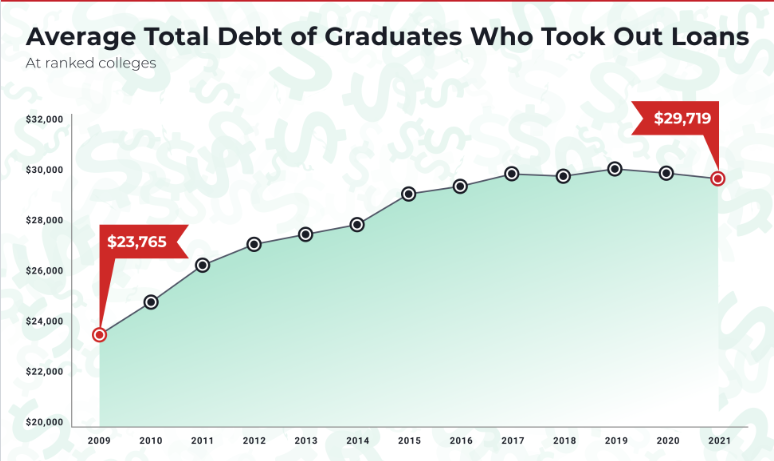

Average student loan debt has been on the rise as families try to keep up with soaring college costs. Though 2021 college graduates who borrowed to pay for school took out, on average, $208 less in loans compared with the prior year, the average total student debt continues to hover around $30,000, according to U.S. News data.

Eligible borrowers can expect some relief, however, as President Joe Biden announced plans in August to cancel some student loan debt. This will help some borrowers with federal loans, but won’t necessarily cover full need.

According to data reported to U.S. News by 1,047 colleges in an annual survey, graduates from the class of 2021 who took out student loans en route to a bachelor’s degree borrowed $29,719 on average. That’s nearly $6,000 more than borrowers from the class of 2009 had to shoulder, representing a roughly 25% increase in the amount students borrowed.

The average debt of graduates varies based on institution type, per U.S. News data. Those who graduated in 2021 from a ranked private college borrowed more on average, at $31,820, than public college graduates, who took out $26,320.

This debt often has a major impact on the quality of life for those who borrowed to pay for college, experts say.

“The total individual debt number doesn’t really get to the heart of what people are experiencing,” says Cody Hounanian, executive director of the nonprofit Student Debt Crisis Center. “We hear from borrowers every day who cannot afford their student loan payments, who cannot put food on the table.”

Meanwhile, a smaller percentage of students are borrowing money to pay for college. In 2009, about 68% of college graduates had taken on student loan debt, while in 2021 nearly 64% of graduates had borrowed, per data reported to U.S. News.

The average total student loan debt, which includes both federal and private loans, jumped more than $5,500 from 2009 to 2015, but recent years have seen a stabilization of the average amount borrowed.

Borrowing is often tied to the cost of college tuition and fees, which, per U.S. News data, has more than doubled over the last 20 years across ranked private and public National Universities (schools that are often research-oriented and offer bachelor’s, master’s and doctoral degrees).

That rise in tuition and fees continued for the 2022-2023 academic year, with private National Universities increasing their rates on average by about 1.4% from the previous year. But tuition at public National Universities decreased slightly by 1.2% – in comparison, tuition rose by 3% in 2021-2022 from the prior year.

“Realistically, particularly at tuition-driven schools, they have to raise tuition to keep up with their own costs,” says Stacey MacPhetres, senior director of education finance at Bright Horizons College Coach. “It makes the student debt crisis a greater endeavor but I’m not surprised that we are seeing tuition rising. We have seen some schools freeze tuition or go with a standard four-year tuition rate that will sort of stabilize. But by and large, we are seeing more increases.”

Student loans are already a significant burden for many Americans, especially given the recent rise in inflation. National student loan debt was almost $1.6 trillion in the second quarter of 2022, according to a quarterly report by the Federal Reserve Bank of New York issued in August 2022.

There’s also a severe racial disparity within student loan default rates. A 2020 Student Borrower Protection Center study, for example, found that the default rate in the U.S. is nearly twice as high in majority-Black zip codes – 17.7% – than in majority-white ones, 9%. Majority Hispanic zip codes fell between those default rates at 13%. Defaulting often occurs after more than 270 days of no payments, leading to potential legal implications and lost eligibility for further federal student aid.

In the wake of additional financial challenges caused by COVID-19, the federal government has provided temporary relief to many federal student loan borrowers. In March 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act, which suspended most federal student loan payments, waived interest and halted collections on defaulted loans through September 2020. After multiple extensions, the pause is set to end Dec. 31, 2022.

In the meantime, borrowers can consider making payments to reduce the principal balance and save money over time, says Heather Jarvis, an attorney specializing in student loans.

“I think many borrowers have benefited from the ability to use their available cash for other necessities rather than for student loan payments,” Jarvis says. “Perhaps an even greater impact has been the suspension of interest because student loan borrowers can sometimes be shocked to see how the passage of time increases the cost of borrowing.”

Additionally, under Biden’s debt relief plan, those who earn less than $125,000 a year, or are in households with a combined income of less than $250,000, are eligible for up to $10,000 in debt cancellation. An additional $10,000 of student debt will be erased for Pell-eligible borrowers who received Pell Grants, federal need-based aid, during college.

“The $10,000 in forgiveness will impact a lot of borrowers. It could reduce their debt by half or even wipe out their debt,” says Kristin McGuire, executive director for Young Invincibles, a national advocacy and policy nonprofit organization. “The $20,000 is a really great advancement to this policy to really start digging into some of the root causes of the student debt crisis. Because if we look at the student populations who need the most help, they are typically Pell-eligible.”

Some borrowers are also receiving assistance from their college or university. Using federal emergency funding from the CARES Act and the American Rescue Plan Act of 2021, a few institutions paid off student debt owed directly to the schools. Georgia Southwestern State University, for instance, cleared overdue unpaid balances for 82 students enrolled between spring 2020 and spring 2021, totaling more than $110,000. This step could free up money for student loan payments that would have instead been used to pay the school.

As prospective students start thinking about college, McGuire says they shouldn’t let fear of debt stop them from attending – especially if they are from a low-income home.

“A college education is the best way to lift yourself out of generational poverty,” she says.

Trying to fund your education? Get tips and more in the U.S. News Paying for College center.